Three Must-have Security Features for FinTech Apps

Author & Editor

Senior Software Engineer

Published on: Nov 29, 2022 Updated on: May 16, 2024

These security features for fintech apps are absolutely non-negotiable – unless you want to lose customers, that is.

When it comes to financial technology (fintech) mobile apps, security is of utmost importance. In order for mobile app development for financial technologies to be successful, it must have features that will ensure the security of users' data.

READ ALSO: How to Protect Customer Data Privacy in Digital Marketing

These features may include biometric authentication, the use of encryption technology, and secure login mechanisms. Without these features, users may be reluctant to store their personal financial information in the app, potentially harming its success.

ADDITIONAL READING: 5 Fintech Problems That May Drive Customers Away

It's therefore important for developers who are creating a fintech app to make security a top priority. By implementing security features, they can help reassure users that their data is safe and protected.

Important security features for fintech apps

To help you in developing more secure fintech apps, here are a few features we’d like to recommend.

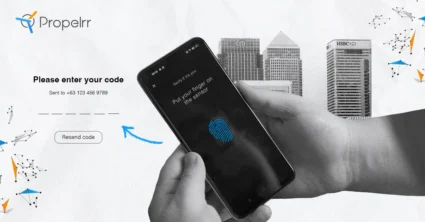

1. Biometric authentication

This feature uses unique physical characteristics like fingerprints or retina scans to verify users' identities. This helps to ensure that only authorized users have access to the app's features and data.

How biometric authentication makes apps secure

One of the features that make a fintech app successful is biometric authentication. This uses unique physical characteristics like fingerprints or retina scans to verify users' identities. This helps to ensure that only authorized users have access to the app's features and data.

This is important because it helps protect user data from unauthorized access. It also helps to prevent fraud, as it is harder for someone to impersonate another person if they don't have the correct biometric information.

This feature is becoming more and more common in fintech apps, as people are becoming increasingly aware of the need for security. It is important for any fintech app to have this feature in order to ensure the safety of its users' data.

2. Encryption technology

This feature helps protect user data from being accessed by unauthorized individuals. By encrypting user information, developers can help keep it confidential and safe.

Encryption technology is a key feature of many fintech apps. It helps protect user data from being accessed by unauthorized individuals. By encrypting user information, developers can help keep it confidential and safe.

This is done by using a cryptographic algorithm to scramble data into an unreadable form. Only authorized users with the correct decryption key can access the information. This helps to ensure that user data is not stolen or compromised.

Encryption technology is becoming more and more common in fintech apps, as people are becoming increasingly aware of the need for security. It is important for any fintech app to have this feature in order to protect the privacy of its users.

3. Secure login mechanisms

These mechanisms help protect user data from being accessed by unauthorized individuals. By using strong passwords or other authentication methods, developers can help keep user information private and safe.

Secure login mechanisms are an important part of any fintech app. By using strong passwords or other authentication methods, developers can help keep user information private and safe.

One example of a secure login mechanism is two-factor authentication. This involves requiring users to provide two pieces of information in order to log in. One is usually a password, while the other can be a PIN, biometric information, or a code sent to the user's phone.

This helps to ensure that only authorized users can access the app's features and data. It also helps to prevent fraud, as it is harder for someone to gain access if they don't have both pieces of information.

Two-factor authentication is becoming more and more common in fintech apps, as people are becoming increasingly aware of the need for security. It is important for any fintech app to have this feature in order to protect its users' data.

How to use a fintech app safely and securely – tips for users

Part of helping users achieve more data privacy and protection online, we must also be advocates of it ourselves.

Here are a few tips for using fintech apps securely that you can share with your customers:

- Use strong passwords. When creating your account, be sure to use a strong password. This means using a mix of letters, numbers, and symbols. It is also a good idea to change your password regularly.

- Enable two-factor authentication. Two-factor authentication can help protect your account from unauthorized access. This involves requiring users to provide two pieces of information in order to log in. One is usually a password, while the other can be a PIN, biometric information, or a code sent to the user's phone.

- Avoid public Wi-Fi networks. Public Wi-Fi networks are not very secure and can be easily hacked. If you need to use the internet while you're out, try using your data plan instead.

- Be careful when clicking links. Be careful when clicking links in emails or on websites. Cybercriminals often use fake links to steal users' personal information. Only click links that you trust.

- Keep your software up-to-date. Keep your software up-to-date by installing the latest security updates from the manufacturer. This will help protect your device from malware and other online threats.

Key takeaways

Maintaining security and privacy online is an equally shared responsibility among your developers, you as the brand, and your customers. Making sure that you watch out for each others’ online safeties has huge pay-offs like:

- Better feedback. Customers are quick to talk about something they didn’t like about your app versus what they liked about it. If they notice that your app is not optimized for security or other important features, count on a bad review pulling down your ranks on the App Store.

- Continued business. The more reliable you are in safeguarding user security online, the more people will trust and want to do business with you. Don’t skimp out on it because of small reasons like costs or production time. Launch a safe app, or don’t launch one at all.

- Business growth. In a similar light as the previous point, happy customers will recommend your business to their peers. If they’re happy with how user-friendly and secure your app is, count on them to promote it to their friends and family, earning you more business.

Do you have other wishlist features for your fintech app? Let’s talk about it on Facebook, X, and LinkedIn. We’d love to see if we can pull it off.

For more tips on how to create secure and user-friendly mobile apps, make sure to subscribe to the Propelrr newsletter so we can send it straight to your inbox.