7 User Story Examples to Guide Your Fintech Mobile App’s UX

Propelrr

February 8, 2023

Take a look at these customer-centric user story examples for building your fintech app.

User experience design demands imaginative and inclusive thinking. Hence, digital marketing agencies write stories before proceeding with the build.

Users always come first. Whether you’re developing websites or apps, the user is central to the conceptualization and production.

This is because the business that is brought in by apps and websites is only won when customers are made and kept happy. For an industry like fintech, nothing is truer. If the experience of your fintech app is less than ideal, you lose customers fast.

Hence, user experience (UX) design – every step and resource it involves and requires– is one of the things financial service companies invest in. And the most critical aspect – user stories – is researched and written with meticulous care.

Because good design elements for fintech matter for nothing when the user story doesn’t align with the actual customer’s needs. Let’s discuss why that is, along with some sample storyboards for UX below.

What are user stories and their benefits to Fintech app development?

In the fintech industry, using user stories is a must to produce an app with great security, clean code, and efficient functionality. User stories are told from the customer’s perspective and focus to record a specific app feature, such as digital financial services like sending money, withdrawing cash, and paying bills.

So, how does looking through the perspective of the end-users benefit your fintech app development? Let’s take a look at these perks of having user stories:

- Highlight the needs of the end-users by directly understanding and prioritizing their challenges and pain points that need to be addressed.

- It promotes faster team collaboration and transparency. The development and the business team can easily develop new features.

- Satisfies your users by adjusting your app’s features in line with their needs, creating a greater in-app user experience.

How to write a user story example for fintech apps?

To keep the process of writing a smooth user story, you’ll need to understand its essential elements. This will help you to develop a logically written user story that any reader can follow. Here are the basic elements a user story has:

- A description;

- acceptance criteria, and;

- teams or members

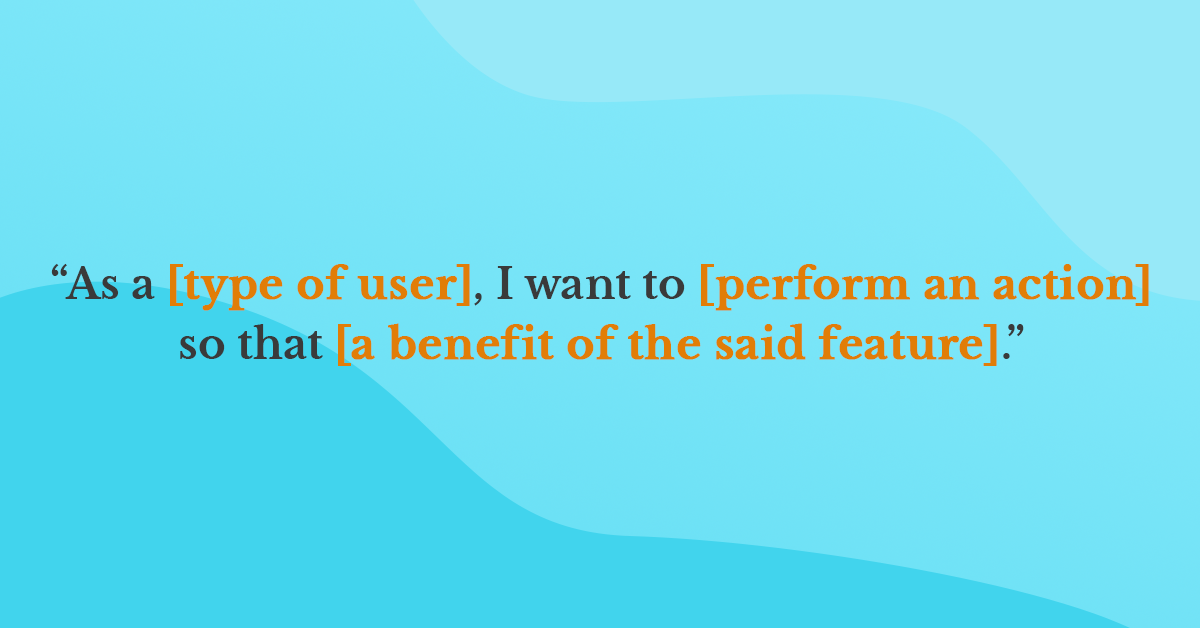

In writing user stories for fintech mobile apps, you can use this simple format:

Figure 1. User Story Format. Using this simple format can guide you in creating clear and easily understandable user stories for developers and stockholders to understand. Photo by Propelrr.

Just take note that in writing user stories, you should keep them short and simple. It should not use ambiguous and redundant words to be easily understood.

If you want a full how-to, here is an in-depth guide on how to write user stories you can use.

User story examples for fintech apps

Now, to illustrate our point and to support the above details about user stories, here are some written agile user story examples to articulate the fintech mobile app features from the customer perspective.

1. User story for transferring money

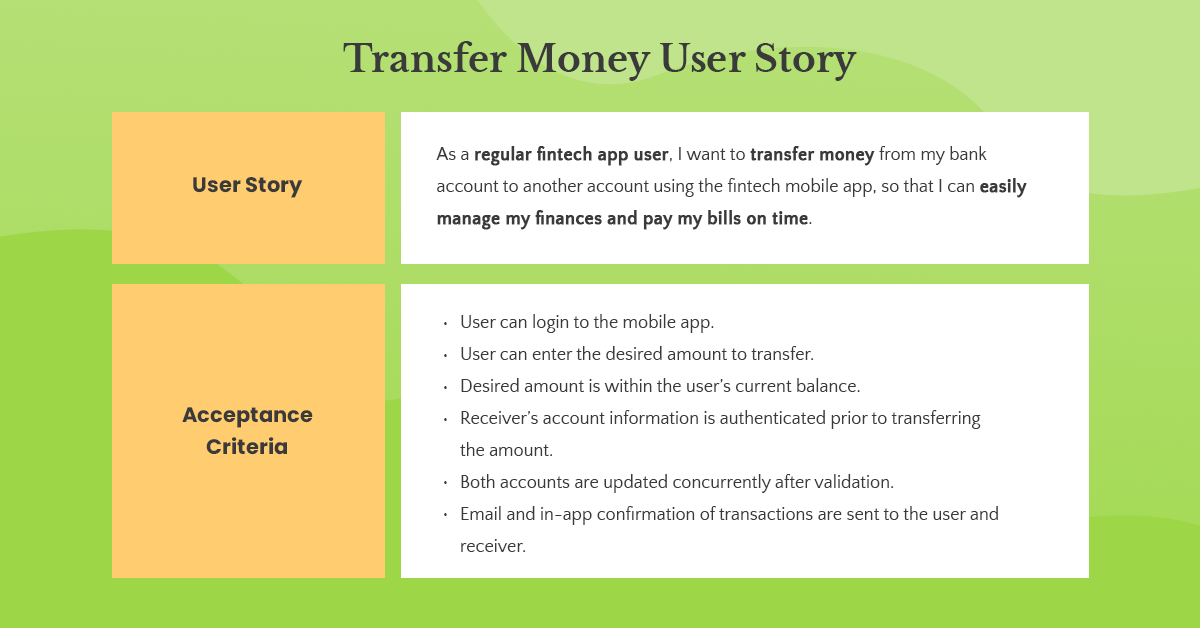

Sending money through mobile apps can speed up the transaction process. Unlike checks, digital money transfers can be instantly processed, making it easier to manage the user’s finances, and not cause delays, especially on large transactions.

Aside from the fast processing speed, money transfers through fintech apps also reduce service charges and paperwork. They can offer external bank transfers with lower fees. Using the steps above, you’ll be able to generate a user story on money transfers just like this one:

Figure 2. User story for transferring money. A basic fintech feature is transferring money from one bank to another. This is an example user story you can use for the specific feature. Photo by Propelrr.

2. User story for withdrawing cash

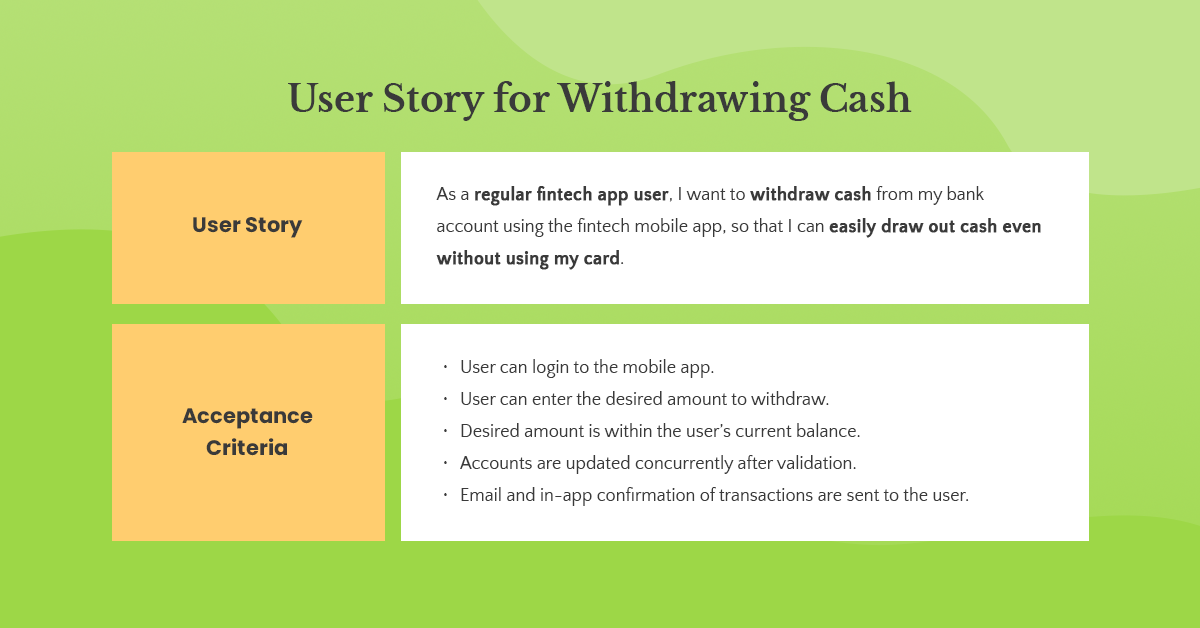

Another innovation fintech offers is the convenience of withdrawing money online. Money can be withdrawn online if users have means of retrieving the physical cash through cardless cash automated teller machines (ATM). But how do they work, you say?

Users are given a unique code via text message or a fintech mobile app that they can input into a cash machine to withdraw money without using their cards. This cardless technology can be drawn using quick response (QR) codes or near-field communication (NFC).

Check out this user story about withdrawing cash online.

Figure 3. User story for withdrawing cash. Other than transferring, withdrawing cash is also an essential feature fintech apps have. To help map out your user story for this one, you can use the example above. Photo by Propelrr.

Withdrawing cash online is often used in case of emergencies (when customers forget to carry their cards), and can enable users to share with their trusted family and friends.

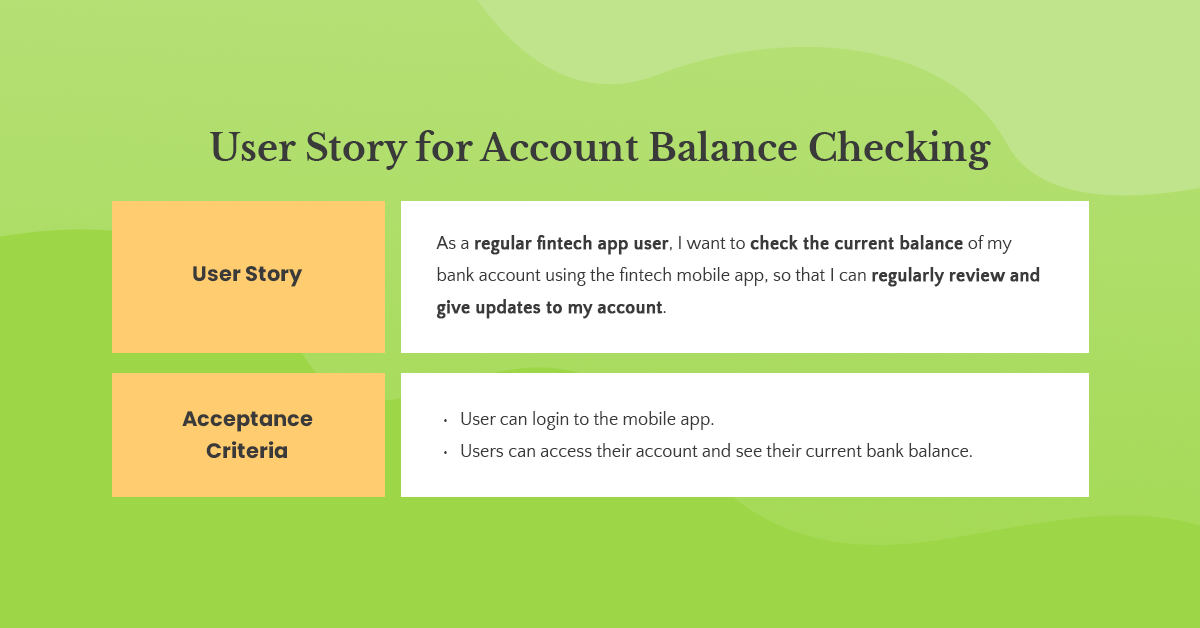

3. User story for checking your account balance

It’s important for your customers to know how much money they have in their accounts and how much of their balance can be used for spending. So regularly checking their accounts physically through the bank could bring so much hassle for them.

This is one of the biggest conveniences fintech resolves in their mobile apps. As long as users are enrolled in the digital services, they can easily check their balances as easily as ABC.

Let’s hear this user story regarding this matter below:

Figure 4. User story for checking your account balance. While transactions are essential features, even simple activities such as checking your account balance are necessary. To give you an idea of how you can map out the user story for that one, check out the example we provided. Photo by Propelrr.

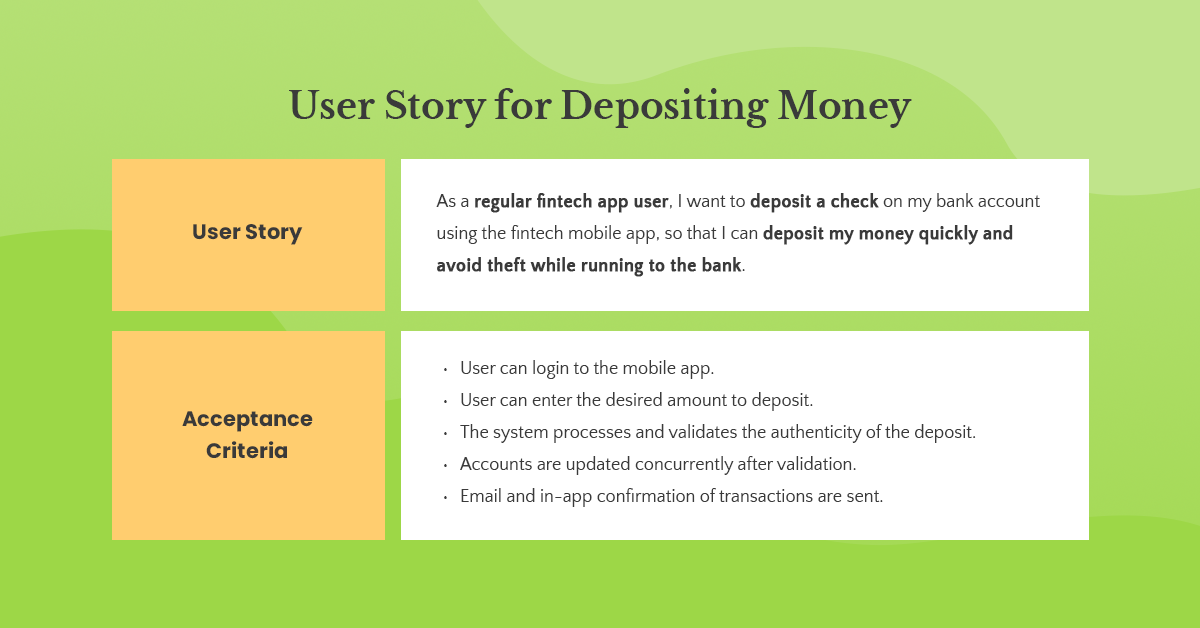

4. User story for depositing money

Now, what if users want to add more money to their accounts without physically going to the bank? Well, fintech made this an easy peasy for customers too!

Through the mobile deposit feature, the user can take a picture of the check then upload it through the bank’s mobile app. Have this user story on mobile deposit feature:

Figure 5. User story for depositing money. Of course, to send money out, you need money going into your account. This user story will help you in mapping out this depositing feature to guide developers and stakeholders. Photo by Propelrr.

As long as the app holds great security standards and implementations, this feature is generally safe. fintech mobile apps check the image directly taken from the app, not stored in the user’s mobile device.

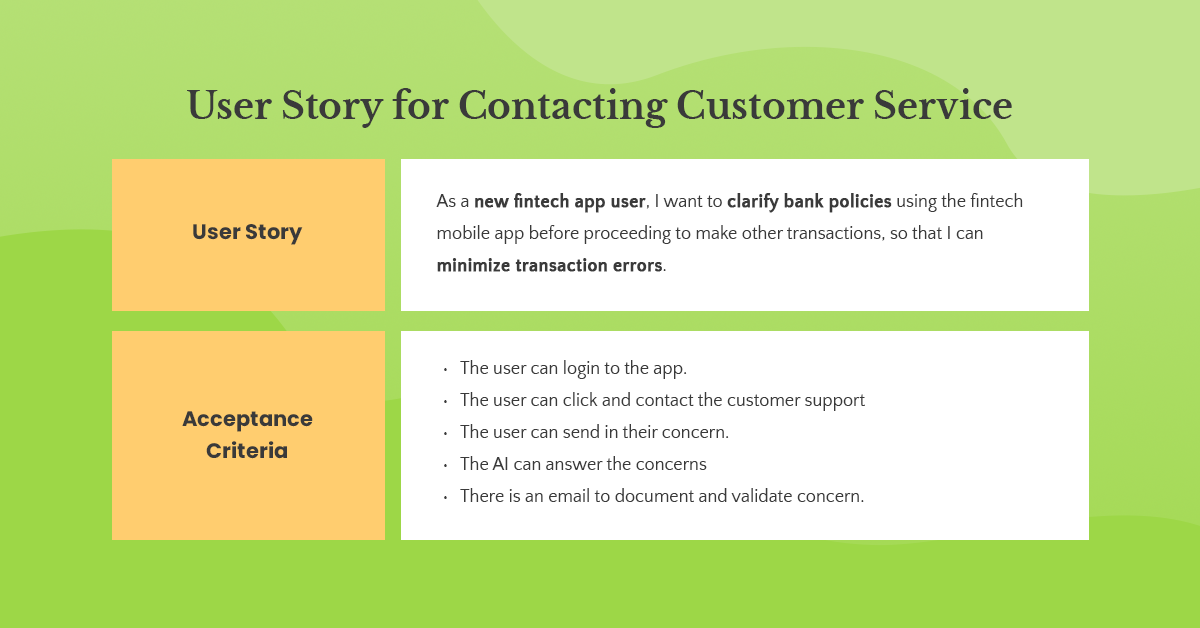

5. User story for contacting customer support services

Understanding the banking procedures can sometimes cause us to be at our wit’s end and this is where customer support services come our way.

The main goal of good customer service is to prevent confusion and address additional requests from customers. But some customer queries can be repetitive, hence answering them through artificial intelligence (AI) software can optimize agent availability and reduce waiting time.

Here’s how fintech mobile app implements a user story in accordance with this particular user need:

Figure 6. User story for contacting customer support services. Good customer service is one service that helps you build and strengthen the relationship with your users. To ensure your users are well-assisted, you can follow our sample user story to get started. Photo by Propelrr.

TIP: Always ensure you have good customer service procedures in place! The lack of ease and convenience to contact your team or get support is one way to drive users away from your app – trust us, you don’t want that happening any time soon.

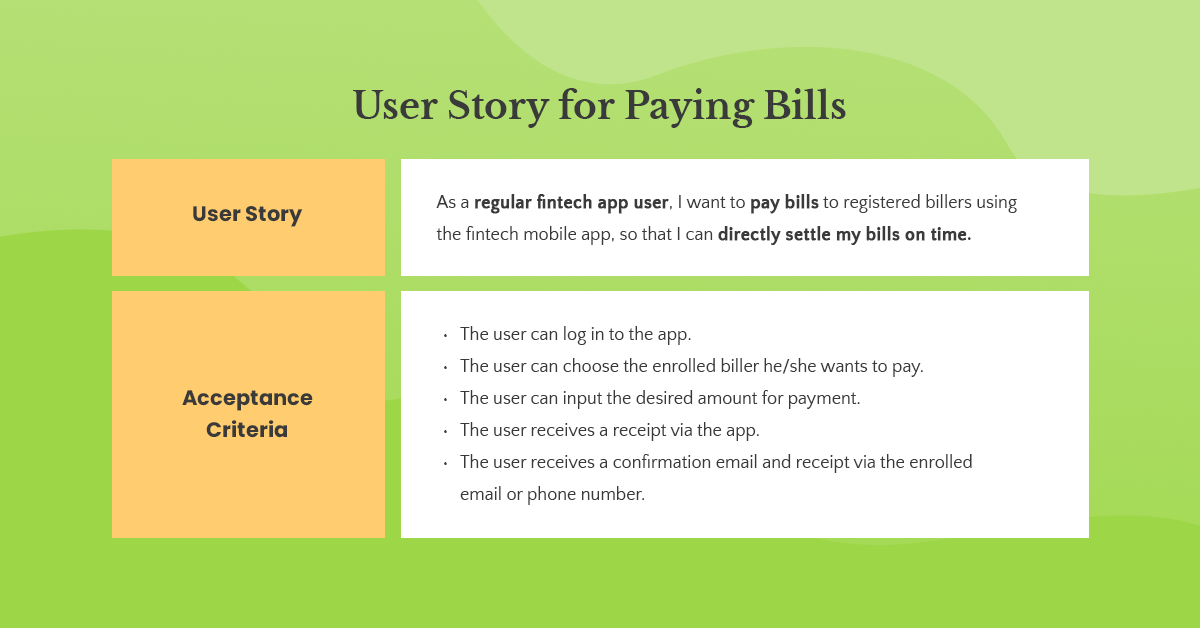

6. User story for paying bills

In all available ways to pay, there’s no doubt that mobile payments are the most convenient, secure, and fastest in all. Mobile payments are also available 24/7 so your customers can immediately do these transactions any time of the day.

Figure 7. User story for paying bills. Bills payment is a recent fintech app feature that has tremendously helped users keep all their monetary transactions in order. Include this in your fintech app features with our example above as a guide. Photo by Propelrr.

7. User story for creating a new account

Fortunately, opening a new bank account is now quick and easy, too! It only takes several minutes to save the customers a trip to the bank. Check out this user story example in opening a bank account online.

Figure 8. User story for creating a new account. Before using the app, the user must be able to sign up or create an account. Keep your process aligned and simple by following our sample. Photo by Propelrr.

Key takeaways

Just as technology enhances, the fintech industry offers more variety of features designed to make financial transactions more convenient. You see, integrating user stories in your fintech app development process can be easy, but creating user stories can be hard. So here are things to take note of along the way.

- Use the right user personas to discover the right stories. The fintech industry can have a lot of users so categorizing them will make your job easier.

- Guide yourself in writing user stories through examples. This will help you know what to ask of your user story writers.

- Make your fintech app development an address to user stories. Users come first. They are the stakeholders of your project so addressing their needs using user stories is your way to your project’s favorable success.

Did these tips help you gain insight into how to optimize the user flows for your fintech apps? Make sure to let your peers know by sharing this story on Facebook, X, or LinkedIn.

To get direct tips on mobile app development and UX design, subscribe to the Propelrr newsletter so we can drop them into your inbox.